Saya Merencanakan Pernikahan dan Saya Menghasilkan $65,340/Tahun

Selamat datang di YNAB Money Snapshots—tempat Anda melihat gambaran nyata anggaran dan keuangan orang lain. Semuanya anonim, karena berbagi uang masih menjadi topik yang tidak jelas bagi banyak orang, tetapi menurut kami dengan menyiarkannya secara terbuka membuat Anda lebih baik dengan cerita uang Anda sendiri.

Saat Anda membaca anggaran ini, ingatlah bahwa beberapa orang menghasilkan banyak uang dan beberapa orang menghasilkan sedikit uang, tetapi kami tahu itulah yang Anda lakukan dengan uang itu dan bagaimana Anda merasa tentang uang itu berarti lebih dari gaji tahunan.

Lihat bagaimana manajer rantai pasokan yang baru-baru ini terlibat di Missouri menghasilkan $65.340 setahun menghabiskan uangnya di bulan Mei.

Tentang

- Nama: Samantha

- Usia: 29

- Lokasi: Missouri

- Pekerjaan: Manajer Rantai Pasokan

- Situasi kehidupan: Saya baru saja bertunangan! Saya juga mendukung sebagian orang tua yang cacat.

Penghasilan:$65.340

Penghematan:$78.207

- Penghematan:$4,000

- 401rb:$37.857 dalam 401rb akun

- Program Kepemilikan Saham Karyawan:$36.350

Utang:$25.800

- Pinjaman pelajar atas nama saya:$7.000

- Saya juga membayar pinjaman orang tua atas nama ibu saya:$18.800

Aliran Masuk Mei:$5,589

- Bantuan federal:$2.592

- Penggajian dibawa pulang:$2,997

Anggaran Mei

Anggaran

| Kategori | Jumlah Target | Catatan |

| Tagihan Bulanan | ||

Internet  | $24 | |

Sewa  | $200 | |

Asuransi  | $71 | |

Air  | $27 | |

Listrik  | $47 | |

Biaya Bank  | $9 | |

Langganan Perangkat Lunak  | $159 | Google Play, Prime, Audible, Aplikasi Pembuatan Bir Kombucha, dan beberapa aplikasi kebugaran |

Ponsel  | $58 | |

Netflix  | $13 | |

| Pengeluaran Bulanan | ||

Makan Malam – Terlambat  | $21 | |

Bahan makanan  | $468 | |

Transportasi  | $58 | Biasanya mendekati $120 |

Kedokteran  | $0 | |

Barang Rumah Tangga  | $88 | |

Amal  | $0 | |

NPR  | $20 | |

Pajak Bodoh  | $0 | Ketika saya merasa bodoh tentang sesuatu (tiket ngebut, perpanjangan garansi saya tidak perlu) saya tetap di sini dan meninjau berapa banyak uang yang saya habiskan yang seharusnya tidak saya perlukan jika Saya lebih berhati-hati |

| Beban Umum | ||

Perbaikan Rumah  | $996 | |

Utilitas Melewati  | $0 | |

Pemeliharaan Otomatis  | $0 | $42 dihemat |

Sewa Lewat  | $0 | |

Basil &Bourbon  | $0 | |

B  | $480 | |

Natal  | $0 | |

Pakaian  | $45 | |

Hadiah  | $32 | |

Perjanjian Rambut  | $0 | Biasanya buka 5 appts/tahun dengan harga $175/appt. |

Kesehatan &Kecantikan  | $48 | |

Perbaikan Rumah  | $648 | |

Ibu  | $0 | |

Ongkos kirim  | $0 | |

Pajak  | $0 | |

Kerja  | $0 | |

| Pembayaran Hutang | ||

Kartu Kredit  | $0 | |

Simpanan Pinjaman Mahasiswa  | $0 | |

Pinjaman Mahasiswa  | $0 | |

| Tujuan Kualitas Hidup | ||

Penghematan  | $0 | $4K dihemat |

Kebugaran – $36  | $65 | |

Tantangan Mini-Game  | $0 | |

| Hanya untuk Bersenang-senang | ||

Dekorasi untuk Pesta (yang saya miliki)  | $0 | |

Acara Teman / Keluarga  | $0 | |

Tanaman  | $268 | |

Buku  | $0 | |

Pembingkaian  | $0 | |

Film  | $40 | |

Kerajinan  | $0 | |

Liburan  | $0 | |

Konser  | $0 | |

Tanggal Malam  | $0 | |

Makan di Luar  | $41 | |

Game Papan  | $0 | |

Uang Menyenangkan  | $117 | |

| Perawatan Hewan | ||

Makanan Kucing Dalam Ruangan  | $124 | |

Makanan Kucing Luar Ruang  | $0 | |

Item Perawatan Hewan Peliharaan  | $51 | |

Sampah  | $0 | |

Mainan Hewan Peliharaan  | $0 | |

Dokter hewan – Django  | $0 | |

Dokter hewan – Milo  | $0 | |

Dokter hewan – Kucing Luar Ruangan  | $248 | |

| Pernikahan | ||

Undangan  | $65 | |

Fotografi  | $0 | Total $1.500, pembayaran berikutnya jatuh tempo pada bulan Juli |

Makanan  | $0 | |

Tempat  | $0 | Perlu menghemat $1,220 (ditambah ekstra untuk deposit kerusakan) |

Pakaian  | $0 | |

Lain-lain  | $153 | |

| Total Dibutuhkan$4.684 | ||

My Savings Categories

Well, really saving for a rainy day currently. My salary has been reduced with our company going on work share (and this will continue through the end of July when the federal assistance ends). Our company’s current financial projections have us doing work share through the end of the year, so we’re trying to save more in anticipation for a 20-40% wage cut for the last six months of the year.

If things pick up, we will shift our savings to wedding planning.

How We’re Handling Our Wedding Costs

We are splitting the cost of the wedding according to our portion of take-home pay, so I am paying 61% of the cost. We’re paying for the whole thing ourselves and hoping for a small quaker-style wedding. We’re hoping to pull it all off for $11,000 and to pay it in cash. All of our vendors have been amazing in creating super flexible payment plans for us so we could reach the goal of being debt-free before the wedding.

I’ve been dubbed the CFO of the relationship and have created payment schedules for us to follow. We alternate who makes what payment each month up to our allotted $ amount.

My Month

May was good to us after we rallied behind a savings plan. I have $4k in Savings but my fiancé is closer to $6k. I did the math and even if there is a 40% cut to our salaries, we could nearly break even with federal assistance if we didn’t spend it all.

We did end up doing some home improvements with being home all the time and bought dirt, planters, patio furniture, and string lights.

My Story

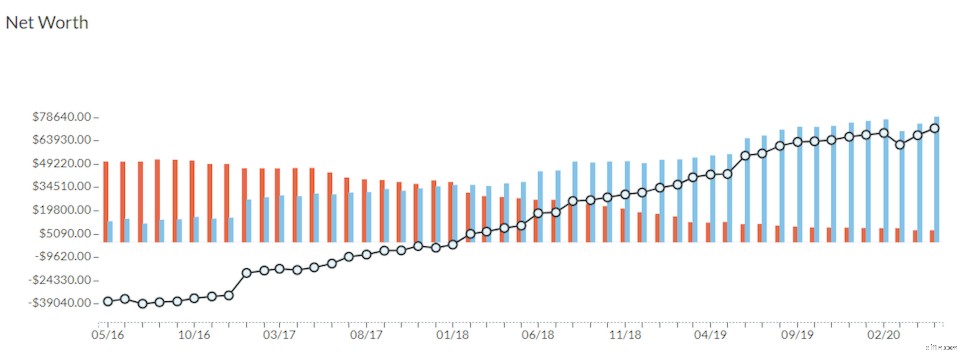

I found YNAB when I was making roughly $30k a year and had $60k in debt to pay off. I had come from a family living paycheck-to-paycheck and whose budgeting plan looked more like a shell game.

It was like a bolt of lighting of realization and stress in 2014 when it hit me that my debt, in theory, could be called in at any time and I would not be able to repay it. After a solid panic, I started to create a plan to pay off the phone, credit cards, and multiple student loans. I’ve been doing just that slowly since 2014 through an MBA, two moves and promotions.

I’ve both relaxed and tightened my spending at various points throughout this process. Despite how much debt I’ve paid off, I am a spender at heart. It has been a process to rewire my brain to get as much enjoyment sending money to debt as, say, on the aforementioned patio furniture.

When I started getting out of debt, I even cut internet out of my budget and definitely didn’t have any subscriptions. Now I allow a couple concerts and some larger purchases not driven by debt. In between the start of debt payoff and now, I’ve bounced to austerity and back depending on how I felt like I was doing on the larger goal.

I am so close I can taste it!

My Financial Goals

2020 is about paying off the last of the student loans in my name, cash-flowing a wedding with my partner, and saving up 3-month emergency fund with our current work situations.

I would rate my current financial situation:5/5

Like YNAB Money Snapshots? If you see a story like yours isn’t being told, we’d love to hear from you: fill out the form here!

anggaran

- Merencanakan Pernikahan dengan Anggaran

- Anggaran Pernikahan:5 Cara Menghemat Uang untuk Pernikahan Anda

- 18 Tips Penganggaran untuk Memudahkan Pengelolaan Uang

- Musim semi-bersihkan lemari Anda dan hasilkan uang

- Natal dengan Anggaran:5 Cara Membuatnya Ajaib

- Saya Memiliki Dua Anak, Saya Terpisah dari Suami Saya, dan Saya Menghasilkan $83k/tahun

- Saya 24, Tinggal dengan Teman Sekamar, dan Saya Menghasilkan $62K/tahun

- Milenial dan uang:Perencanaan dan kesiapan keuangan (dan 6 tips untuk mewujudkannya)

-

Apakah DINKs Menghasilkan $ 133K / Tahun dan Menabung untuk Rumah?

Apakah DINKs Menghasilkan $ 133K / Tahun dan Menabung untuk Rumah? Selamat datang di YNAB Money Snapshots—tempat Anda melihat gambaran nyata anggaran dan keuangan orang lain. Semuanya anonim, karena berbagi uang masih menjadi topik yang tidak jelas bagi banyak orang,...

-

Kami Menghasilkan $67.000/Tahun dan Saya Melunasi Kartu Kredit Terakhir Saya

Kami Menghasilkan $67.000/Tahun dan Saya Melunasi Kartu Kredit Terakhir Saya Selamat datang di YNAB Money Snapshots—tempat Anda melihat gambaran nyata anggaran dan keuangan orang lain. Semuanya anonim, karena berbagi uang masih menjadi topik yang tidak jelas bagi banyak orang,...